A “commsversation” between Jeff Knezovich, Melissa Julian and the communications team at ECDPM.

The current set of posts is designed to help organisations to pause and reflect on their communications offer to understand if and in what ways their communication products may need to change. The posts suggest a three-pronged approach: a knowledge audit, a market analysis and an audience assessment. This post focuses on the first two elements — conducting a knowledge audit, and a market analysis.

Undertaking a knowledge audit

When it comes to understanding the internal context of an organisation, creating a set of core lists should have helped identify what sort of outputs are currently (and maybe even historically) part of the communication effort at a given organisation. These lists can also help surface some basic descriptive information about the content – e.g. how many policy briefs were produced in the last year, if the organisation is producing more or less of certain outputs than in previous years, etc.

However, these lists might not be so good at adding an understanding of whether or not the communication offer is currently (let alone in the past) successful. Organisations may have ‘legacy’ outputs that are no longer relevant. And even if the current range of products is reaching the right people, they might not continue to do so in the near future as contexts change.

To get a more complete picture, then, we recommend starting with a knowledge audit. This looks not only at what sort of communication products exist, but also the processes and flows of information throughout an organisation.

Many others have endeavoured to explain the steps for completing a knowledge audit. See for example ODI’s Knowledge Management Toolkit, the Asian Institute of Journalism and Communication’s unit on Conducting a Knowledge Audit, or this article from Inside Knowledge Magazine. As such, I won’t set out a step-by-step guide here.

Rather, I want to highlight some questions to ask during a knowledge audit that are most relevant to strengthening a communication effort.

- What are the most common knowledge products for internal, quasi-external (board members, partners, etc.) and external audiences?

- What are one-three examples of the most ‘successful’ knowledge products and why?*

- What are the most used knowledge products among audiences?

- If the organisation mainly works on a project basis, what are the most common outputs promised in contracts and/or demanded by funders?

- Is the range of outputs in keeping with the business model and unique selling points of the organisation?

- Are the outputs appropriate for the types of audience targeted?

- Are there any noticeable gaps in the range of outputs produced?

- Is the range of outputs realistic given current resourcing? If not, what should be prioritised?

(* ‘Successful’ is in inverted commas above because defining what success looks like is a surprisingly difficult task – what looks like success for one organisation might be abject failure for another. We’ll discuss monitoring and evaluation toward the end of this series, which discusses this in greater detail.)

My three top tips for an effective institutional knowledge audit?

1) Engage outside the communications team: It’s important to use a knowledge audit to open a conversation about the current communication outputs to see if they fit with the values of the wider institute. One of the most effective ways I’ve seen to do this is to compile key descriptive facts gathered from the core lists and presenting them as part of a quiz. For example, a question could be: ‘In the last five years, what percentage of our research outputs have been briefings?’ or ‘Last year, what was the most accessed resource on our organisation’s website?’. After revealing the answer, have a discussion about why that may be and if those in the organisation are generally happy about where things are.

2) Bring in outside views: Solely internal assessments of products are useful, but it’s difficult to be entirely objective. Assembling a friendly but external review panel can help move the conversation in ways that keeping it entirely internal cannot. It’s particularly good if at least one of those on the panel represents a clear target audience for the organisation.

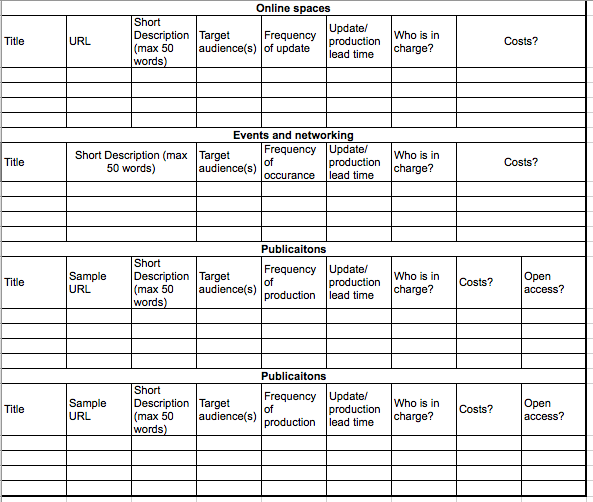

3) Look beyond products: A good knowledge audit also considers existing relationships and networks (both internal and external), and access to existing online platforms. For example, when I joined the Future Health Systems consortium, we reviewed not only the previous outputs of the consortium, but also what some of the existing communication channels were within individual partner institutions. A blank version of that worksheet is below, for reference.

Click here or on the picture to access a live version on GoogleDrive.

ECDPM’s Knowledge Brokerage Assessment Tool

To assess whether to engage in a policy process, how and with whom, we have created an analytical instrument, the Knowledge Brokerage Assessment Tool (see page 19 of our KM&C strategy). The tool helps us to clarify what impact we could potentially have towards our strategic priorities.

We’ve had this tool for years and plan to carry out and refine such assessments per policy process on a rolling basis and proactively as part of our programme work to allow us to better support policy process actors by providing appropriate information, exchanges and dialogue at the right time with the right people and organisations, in the right form and making use of appropriate instruments.

While these issues are discussed constantly with our programme, to date, this tool has been used only implicitly and on an ad hoc basis. This is partly because we must prioritise the maintenance of our existing communications products and commitments, with limited resources, in parallel with creating new tools for more strategic communications planning.

Do other think tanks face similar challenges? How have you addressed this?

Performing a market analysis

Similar to the knowledge audit, a number of various outlets have explained in a step-by-step format how to do market analyses.

One component of a market analysis is understanding those organisations in a similar position and what their competitive advantages are – this is known as a competitor analysis. Another typical part of this analysis is known as a SWOT analysis, which stands for Strengths, Weaknesses, Opportunities, and Threats. In such an analysis, strengths and weaknesses are more internally focused, whereas opportunities and threats consider the external market and competitors. When doing a SWOT analysis, pay particular attention to the links between the four boxes: what strengths will allow you to take advantage of the opportunities and overcome the threats? Ideally, the SWOT analysis should give you a list prioritised around relative impact and probability. This prioritised list can be turned into specific strategies or plans with dates and owners. The SWOT is an excellent way to move from thinking to action.

With an eye only on beefing up the communications activities, I probably wouldn’t perform a full competitors analysis, but would rather focus on their outputs. To do this, look to two or three key competitors and see what sort of content they are producing. If there are external indicators of which ones are the most successful, study those closely. Otherwise start taking notes on what is particularly good about the outputs and what could be done differently.