Forecasting is a central element in any strategic planning process. But it is also important for monitoring the financial health of a think tank. This tools offers to opportunity to monitor income, costs, and assess whether the organisation will be able to meet its responsibilities in the future.

Last year we published the first part of a Stress Test Tool that could help think tanks to look ahead and plan for the future. In this post I present the tool itself, an Excel file that can be customised by anyone.

Many think tanks have a tool like this. If it works well then this is not for them. Still, they may benefit from the analysis that is suggested here. In the end, what matters is that we make use of the information we have to prepare for the future.

Forecasting Tool -draft, open to be reviewed and improved

The instructions for using the Forecasting Tool are as follows:

To test the sustainability of a think tank we must look beyond the past or the present and explore whether the organisation is ready to face future challenges. This capability will be influenced by a number of factors found in the Background Tab.

The stress test presented here is in effect a forecasting tool. At the centre of the tool is a necessary effort, by all staff, led by senior management, to assess the financial health of the organisation in the long term. Looking back, which is what balance sheets would tend to do, cannot protect the organisation from future shocks.

You can Download the Tool here: On Think Tanks Stress Test Forecasting Tool

If you use it, please let us know what you think of it. If you improve it, please share the improved tool with us.

The following steps should be carried out at the individual, project, team or organisational levels. The tool has been designed with 2014 as the base year:

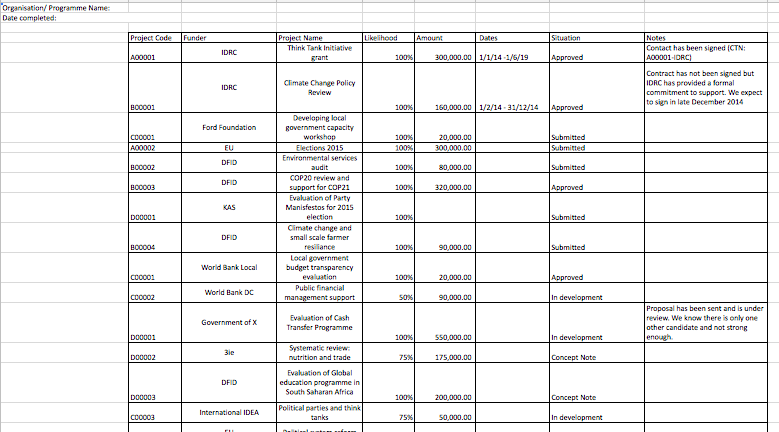

- The Funding table is a tool designed to keep track of possible funding and to serve as input to the Income and Income Scenario tables. This should be kept up to date. This is an example, nothing out of the ordinary.

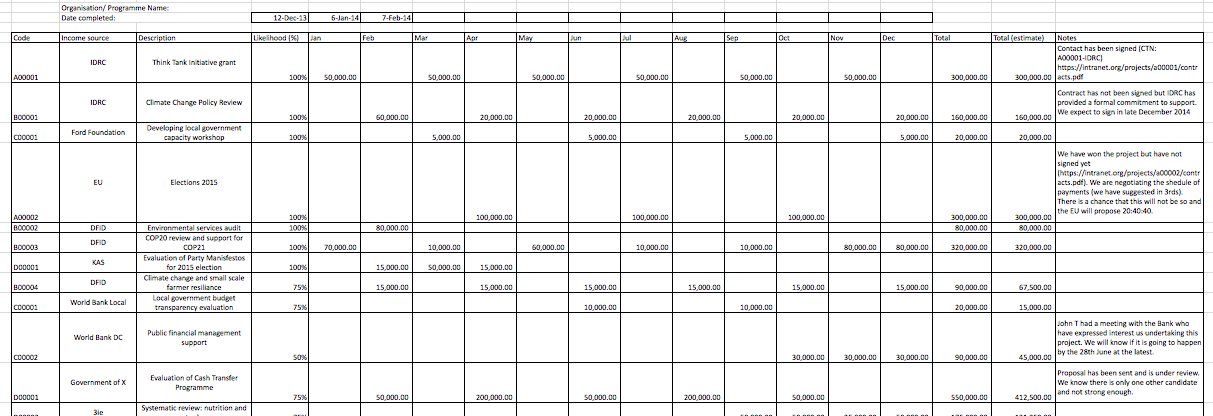

- Complete the Income tables for the Year ahead (2015, in the tabs). This is what this looks like with some examples (some columns have been hidden so that it fits in the screen):

- The Income table needs to be completed using the most up to date information available.This information can be first recorded and reviewed in the Funding Tab which provides a way of monitoring possible future work or funding for the organisation.

- The Codes refer to a part of the organisation -a department, programme, area (e.g. A) and the project number (e.g. 00001). A separate file could be developed for each programme or department (i.e. for A, B, C…). Each think tank may have its own system.

- Funders refer to those directly funding the think tank (but could include a note of the ‘ultimate funder’, too. For instance, the direct Funder could be an NGO holding a contract from a Bilateral agency, the ultimate funder.

- The Project Name refers to the name it is known for in the organisation

- Likelihood: 100% likelihood = there is a signed contract or a formal agreement; 75% = there is an agreement in principle or a well advanced negotiation process; 50% = the organisation has a good chance of ‘winning’ the project. This is informed by the Funding Tab

- The income should then be allocated as and when the think tank expects to receive the funds from the funder. This could be based on a schedule of payment in the contract or Terms of Reference, it could be based on previous engagements with the funder; or may reflect the preference of the think tank.

- All backing evidence, assumptions and concerns should be noted. This is very important.

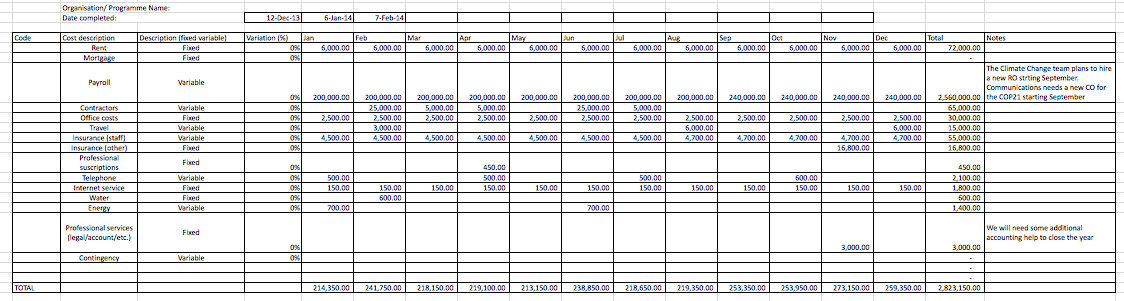

- Complete the Costs tables for the Year ahead (2015, in the tabs). This is what the table looks like in the tool (again, some columns have been hidden). Note that the table is frequently updated and this has to be noted.

- The cost table must be completed using the most up to date information. It should include any plans by the think tank to increase staff, change offices, or any other investment.They should include all costs associated to the projects, including staff costs as well as travel, consultancies, etc.

-

- The Codes refer to the codes used by the think tank’s accountants for each item.

- Fixed costs are not linked to the number of projects or staff (at least not for relatively small or medium changes). For additional information on how to code this, have a look at budgeting for think tanks.

- All backing evidence and relevant information should be noted. Again, very important.

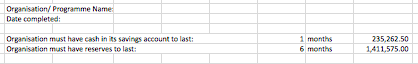

- The team or organisation should estimate its desired minimum shot-term liquidity and long-term reserves. These should allow the organisation to deal with long term and short term shocks. This is could be seen as a rather arbitrary number but should reflect the organisation’s business model and responsibilities.

- Use the Cash Flow table to analyse the health of the organisation:

- Is the income stream constant?

- Does it account for the organisation’s liabilities?

- Does the organisation have enough cash to cover these liabilities?

- Does the organisation have a strategy/plan to address shortfalls?

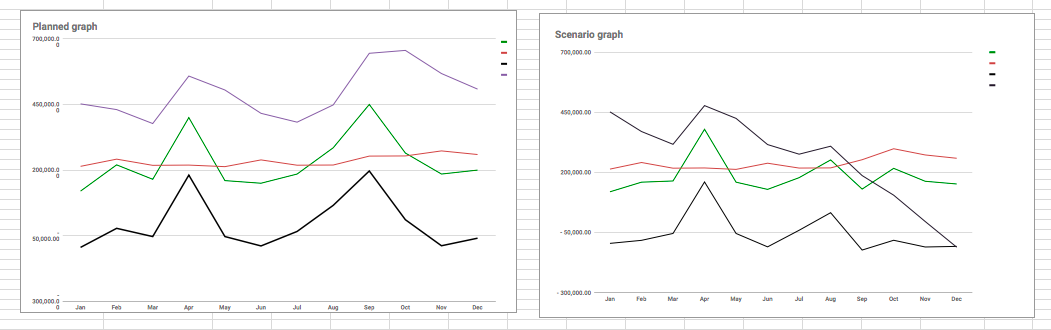

- Can the organisation address possible shocks? Test scenarios using the Income and Costs Scenario tables which can be ‘played with’, e.g.:

- What would happen if the contracts with low likelihood did not come through? Or if the likelihood changed?

- What if the schedule of payments changed for a key project?

- What costs could increase and what could be done?

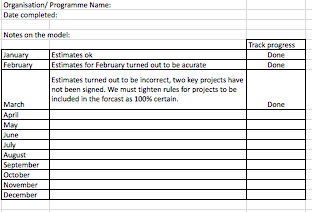

- Take notes of the scenarios tested, the effects, and the actions that need to be taken. The diagrams can help to monitor these different scenarios (for instance in the scenario below, the think tank would have serious cash-flow problems towards the end of the year):

- This process must be repeated every month, looking at the next 12 months (at least). This can happen at different levels: within a team, a programme or area, or at the organisational level.

- At every meeting, ask:

- Was our forecast accurate?

- If there were any significant differences, how can that be explained and corrected?

- All lessons need to be noted and registered.

- At every meeting, ask:

We hope you find this useful. If you use it and have some comments please let us know about them. Also, please share your own tools if you feel like it.